Recent Florida Auto Insurance News: Rates Drop, Reforms Work, and What It Means for Drivers in 2025

In 2025, Florida’s auto insurance landscape is showing signs of relief for drivers after years of steep premium hikes. Thanks to legislative reforms, increased competition, and regulatory oversight, the state’s top insurers are lowering rates, and consumers are starting to feel the benefits. This article dives into the latest developments in Florida’s auto insurance market over the past 60–90 days, drawing from credible sources like the Florida Office of Insurance Regulation (OIR), major news outlets, and industry experts.

We’ll explore why rates are dropping, how reforms are reshaping the market, and what drivers can do to save money. For a broader perspective on how data trends impact industries like insurance, check out this fascinating comparison of global data and storage capacity with an insurance twist.

Why Are Auto Insurance Rates Dropping in Florida?

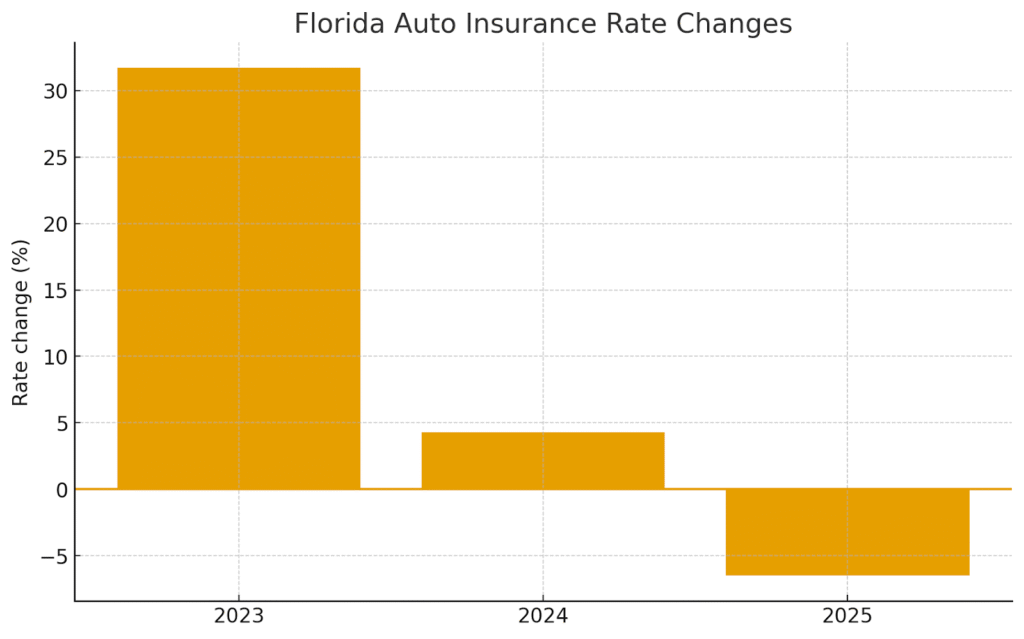

Florida’s auto insurance rates are finally trending downward, a stark contrast to the 31.7% average increase in 2023. According to the Florida Office of Insurance Regulation, the state’s top five auto insurance groups, which control 78% of the market, have requested rate decreases averaging 6.5% for 2025. This follows a modest 4.3% increase in 2024, signaling a significant slowdown in premium growth. Major insurers like GEICO (10.5% decrease), State Farm (6% decrease), and Progressive (8.1% decrease) are leading the charge, as reported by Governor Ron DeSantis in a February 2025 press conference.

The primary driver behind these reductions is a series of legislative reforms enacted in 2022 and 2023. These laws targeted excessive litigation, which had long inflated insurance costs in Florida. By eliminating one-way attorney fees—where insurers automatically paid plaintiffs’ legal fees in successful lawsuits—the reforms reduced the incentive for frivolous lawsuits. Former State Deputy Insurance Commissioner Lisa Miller noted that these changes curbed the influence of “billboard lawyers,” who previously drove up rates through thousands of lawsuits costing insurers billions in legal fees.

How Reforms Are Stabilizing the Market

Florida’s insurance reforms have done more than just lower rates; they’ve reshaped the market’s structure. The 2022 special legislative session introduced Senate Bill 2D, which eliminated incentives for attorneys to mislead claimants and prohibited roofers from absorbing insurance deductibles. Additionally, the Reinsurance to Assist Policyholders (RAP) program provided $2 billion in state-backed coverage to stabilize insurer costs, indirectly benefiting auto insurance by easing financial pressures across the industry.

In 2023, further reforms tightened oversight of insurers, expanded home hardening programs, and limited bad-faith claims. These changes have attracted new insurers to Florida, boosting competition. Since 2022, 11 new insurance companies have entered the market, as announced by Governor DeSantis. This influx has pressured existing carriers to lower rates to remain competitive. The OIR also reported a remarkable 53.3% personal auto liability loss ratio in 2024—the lowest in the nation—indicating improved insurer profitability and market stability.

What the Numbers Say: Rate Changes and Savings

To give drivers a clearer picture, here’s a breakdown of recent rate changes among Florida’s top auto insurers, based on data from the OIR and news reports:

| Insurer | Rate Change (2025) | Estimated Annual Savings per Driver |

| GEICO | -10.5% | $80–$150 |

| State Farm | -6.0% | $50–$100 |

| Progressive | -8.1% | $60–$120 |

| Allstate | -5.0% (est.) | $40–$90 |

| USAA | -3.5% (est.) | $30–$70 |

Note: Estimated savings are based on average Florida premiums (~$1,500/year) and vary by driver profile. Source: Florida Office of Insurance Regulation, South Florida Sun Sentinel.

These reductions translate to modest but meaningful savings for drivers. For example, a GEICO policyholder could save up to $150 annually, while a State Farm customer might see $50–$100 back in their pocket. However, Florida’s auto insurance costs remain among the highest in the U.S., averaging over $1,500 per year, largely due to the state’s no-fault system and high number of uninsured drivers.

The Role of Consumer Behavior in Savings

Increased competition isn’t the only factor driving down rates. Consumers are also playing a role by shopping around more aggressively. A LexisNexis report cited by the South Florida Sun Sentinel noted a 16% year-over-year increase in auto insurance shopping in Q1 2025, with 46% of policies shopped at least once in the past year. This trend encourages insurers to offer competitive rates to retain customers. For busy drivers juggling work and life, understanding why smart auto insurance choices matter can make a big difference in securing affordable coverage.

Visualizing the Trend: Rate Changes Over Time

Below is a rendered chart (PNG) that mirrors the simple SVG bars, followed by the exact SVG code so it’s obvious that it’s an SVG snippet you can copy-paste into HTML or a .svg file.

Figure 1. Florida Auto Insurance Rate Changes (rendered PNG).

Challenges Ahead: No-Fault System and Uninsured Drivers

Despite the positive trends, challenges persist. Florida’s no-fault auto insurance system, which requires $10,000 in Personal Injury Protection (PIP), continues to inflate premiums. Proposed legislation (SB 1256/HB 1181) aims to replace PIP with a fault-based system, requiring $25,000 in bodily injury coverage per person and $50,000 per accident. House Speaker Daniel Perez supports this change, arguing it could reduce costs for drivers. However, past attempts to repeal PIP have stalled, and it remains a contentious issue.

Additionally, Florida’s high rate of uninsured drivers—estimated at 20%—puts upward pressure on premiums for insured drivers. The OIR and lawmakers are exploring ways to address this, but no concrete measures have been finalized in the past 60–90 days.

Practical Takeaways for Florida Drivers

- Shop Around Annually: With 46% of policyholders shopping for new policies, compare rates from multiple insurers to find the best deal. Use online platforms for quick quotes.

- Leverage Telematics: Consider usage-based insurance programs that track driving behavior via apps or devices, potentially lowering premiums for safe drivers.

- Ask About Discounts: Inquire about discounts for bundling policies, safe driving records, or anti-theft devices.

- Stay Informed on Reforms: Monitor legislative changes, like the proposed PIP repeal, which could impact coverage requirements and costs.

- Check Insurer Stability: Verify your insurer’s financial health through ratings from A.M. Best or Demotech to ensure they can pay claims.

What to Watch Next for Florida Drivers

- Legislative Session Outcomes: The 2025 legislative session, ongoing as of September, may finalize the PIP repeal or introduce new transparency measures (e.g., SB 1656/HB 1429), which could affect rates and coverage.

- New Insurer Entries: With 11 new insurers entering since 2022, more may follow, potentially driving further competition and rate reductions.

- Hurricane Season Impact: The 2024 hurricanes (Debby, Helene, Milton) strained insurers, but the OIR’s recent fines for mishandling claims signal stronger oversight, which could protect consumers.

- Telematics Adoption: As insurers increasingly use AI and telematics, watch for new usage-based policies that reward safe driving with lower rates.

Florida’s auto insurance market is on a promising trajectory, but drivers must stay proactive to maximize savings. By shopping smart, understanding reforms, and monitoring legislative changes, you can navigate this complex landscape with confidence.